January Santa Clara Home Sales Recap

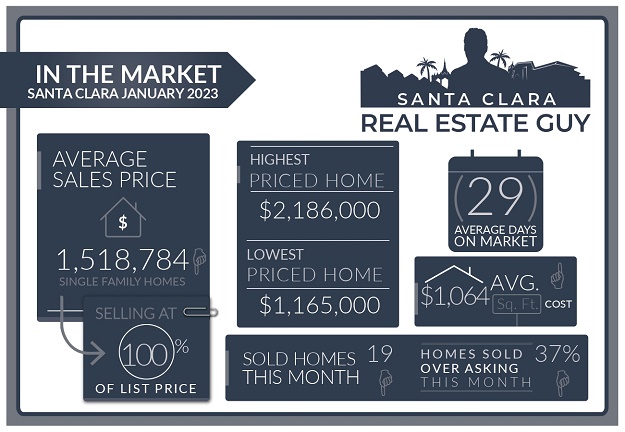

The Santa Clara housing market in January experienced 19 single-family homes that closed escrow, which is 6 less than closed escrow in the previous month of December. For some more perspective, last year there were 34 homes sold in January.

The average price of a home sold in January was $1.52M which is about $115K lower than the previous month’s figure of $1.63M. The median price home sold was $1.48M, about $25K lower than the median price in December.

The average cost per square foot saw a increase from $1037 per Sq. Ft. to $1064 per Sq. Ft. Of all the 19 homes sold in January, 7 homes sold over the list price.

On average homes that sold did so at -0.05% under asking compared to 1.77% over asking in the previous month.

We started the month of January with 21 active single-family home listings and finished with 31 active single-family homes for sale in all of Santa Clara.

For a list of sold homes in January click here or scroll down to the bottom of the page.

Home Sales Down Year Over Year

Home sales slightly increased in December versus November, but dropped significantly year over year.

During the holiday months especially December we see low listing activity and last month was no exception.

This brings us to an interesting situation in our current market, low inventory.

Low inventory when the market is hot because buyers are buying up everything in sight is what we have been used to in the last few years.

In our current market, where buyer activity has dropped you would think that inventory would be high, but that is not the case. A clear indication that sellers are choosing to sit this market out.

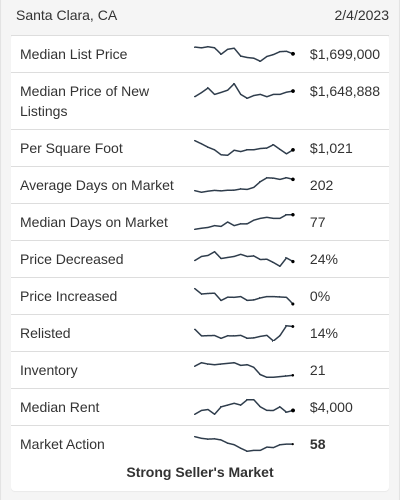

Altos Research Market Data For Santa Clara

Low Home Inventory

The beginning of the year is generally when we will see the lowest levels of homes for sale. This year we started off with 21 single-family homes listed, last year we started off the year with 15 homes.

Perhaps the number you start with isn’t as significant as the number of homes that are coming on the market, and so far this year that number has been really low.

With very few quality properties being listed, there is an inbalance of home buyers versus home sellers.

A prime example of that is our listing on 2880 Mark Ave in Santa Clara, which received 20 offers after being on the market for just one week.

Although national and some local media outlets are reporting a slow real estate market and falling home prices, the reality in Santa Clara and some surrounding markets is that prices are holding up and demand is outweighing supply.

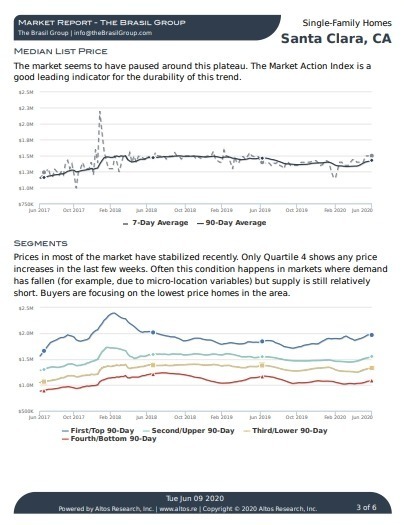

Santa Clara Market Reports

The Altos Research Market Action Index for single-family homes in Santa Clara has increased to 58 from 55 where it was last month. For more detailed reports on Santa Clara and Santa Clara Zip codes, you can access the reports here.

Santa Clara Report

95051 Report

95050 Report

95054 Report

Home Values Holding Steady

As I mentioned above home values under the current low inventory conditions are holding up well, and if home inventory stays low we may not see any home value depreciation.

Its the beginning of the year so no one knows exactly what to expect, but the feeling is that there will be less homes listed for sale this year. How much less? That’s a good question.

Whatever the case, as buyers continue to shop for homes and are faced with little inventory and multiple offer situations those same buyers’ attitudes about the market will start to shift.

As word spreads that homes are getting multiple offers and prices are not dropping, this could be a catalyst for buyers to return and we could see a strong sellers’ market emerging in the coming weeks.

Monitoring inventory levels will determine what direction the market is likely to go. One easy way to do that is with the Altos Research Market Action Index (MAI) with is a proprietary metric that measures inventory and sales activity. The MAI in the last few weeks has been trending upward indicating that the market is getting stronger for sellers.

Other Factors Influencing the Market:

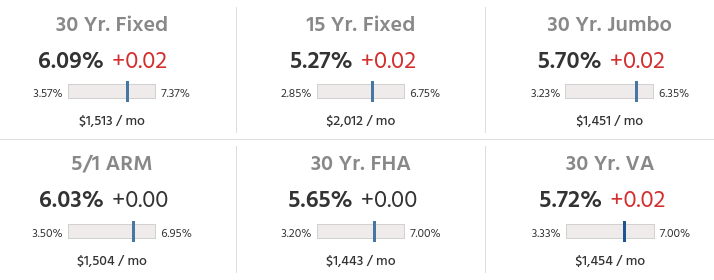

Mortgage rates have been dropping in recent months. In the last few weeks, the 30-year fixed has dropped to the low 6% range. Over a month ago that 30-year fix was above 7%.

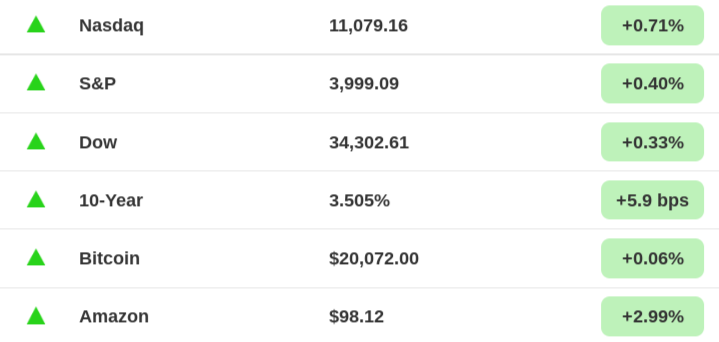

As we started 2023 the markets have been more optimistic about the economy. Wall Street speculation is that the FED will start to lower rates sooner than expected.

Below is a table of rates on a national level. Some of our local lenders are able to lock in rates for Jumbo loans with 5 or 7 years fixed in the mid 5% to low 5% range. This depends on credit scores and other factors.

Markets Year to Date

Since the beginning of the year the stock market has been rallying.

There have been no major developments or changes to fuel the market. Just speculation from Wall Street.

We are entering earnings season and the word on the street is that many CEOs will be pessimistic about the economy moving forward. This may however, be positive for the stock market as bad news means the FED is likely to intervene sooner rather than later.

Home buyers in our local market rely on tech stocks for their down payment and for their loan qualifications. The impact on stock values affects home buyer affordability and purchasing power.

With interest rates dropping, stocks higher, and limited inventory things are looking better for home sellers.

Layoffs around the bay area continue to make headlines. Google just announced 12,000 layoffs across all departments and levels.

You can follow the number of layoffs and what firms have been affected on the San Francisco Chronicle Layoff Tracker webpage.

Save thousands when you sell.

Includes Free Staging and Our Complete Selling Solution

* Total commission 4% including buyer side agent commission of 2.5%, offer varies by value of home.

What to Expect Moving Forward

Buyers, have we hit the bottom?

If you have been looking for a few weeks you probably feel like the market has picked up and it has.

With the current state of rates, stocks, and low home inventory buyers are probably feeling a bit more confident these days.

The question is where do we go from here?

I admit I am really surprised that the stock market has been so positive in the last few weeks. This optimism has also caused mortgage rates to drop close to 6%, something I also didn’t think would happen so soon in the year.

The one thing that I am certain of is that home inventory will likely be low throughout the year.

Although I expect the current stock rally won’t be sustained and that mortgage rates to probably hang around the low to mid 6% range in the next few weeks and months, I don’t foresee a situation where inventory will climb to very high levels.

This will help home values remain strong at least for the short term.

All this optimism isn’t going to be good for inflation and may cause the FED to continue to raise rates.

The last time the FED reversed its rate hike plans in 2018 it may have been prompted by the stock market sell-off. This time the stock market is holding up, and there is inflation which wasn’t a factor in 2018, which makes me wonder if that will prolong the period before the FED reduces rates.

As you can see, there is no way to know how this will play out.

My advice to buyers is to continue to shop and be active. Home buyers are likely to start getting nervous once they hear about the multiple offer situations happening in the market. This can cause more aggressive bidding and competition, so be prepared.

I think in a matter of a few weeks, we will start to see the stock market sell-off

again as the market stalls and the reality of the FED not backing down sets in.

In the meantime, conditions for buying in the market should be improving in the coming weeks as more homes eventually come on the market.

Sellers, there is very little competition out there right now if you are selling a home.

This situation may continue for several weeks, even months. Typically inventory starts to really climb in the March to April months. By May and June the market isn’t moving so quickly because buyers have more homes to choose from and many have already bought homes.

That is what typically happens, I am not so sure that will be the case this year. Sellers seem to be choosing to sit this market out for whatever reasons.

My advice to sellers is if you want to make a move especially if you are thinking of making a move to a market where there is more new construction and supply of homes like Nevada, Idaho, and Texas then this market may be a great opportunity.

There are lots of reasons why selling and buying in this market makes sense. Here is an article I wrote on the advantages of selling in slow markets.

Instead of offering general suggestions here, I would encourage sellers who have questions and concerns about selling in this market to reach out to an agent.

Understanding your specific situation helps in determining how this market will affect you and your options. I offer free consultations to buyers and sellers to discuss their needs, so please reach out, I am always happy to help.

Conclusion:

As always, whether you are buying or selling, understanding the current market will set you up for success. As I mentioned above some homes are doing quite well in this market.

Understand that the housing stock of Santa Clara is very diverse and can vary greatly from one neighborhood to the next.

Developing the right strategy for you, whether you are buying a home or thinking of selling your current home is important to succeeding in this market.

If you have any questions about a home on the market or your home’s value, please feel free to reach out, I am happy to meet and help you understand your options.

Contact Me Today

Have a question? Interested in setting an appointment to talk about your real estate plans? Contact me today.

Message Me Directly:

Santa Clara January 2023 Home Sales

| Street Address | List Price | Price | DOM | Beds Total | Bths | Sq Ft Total | Age |

| 348 Montclair Drive | $2,285,000 | $2,186,000 | 23 | 4 | 2|0 | 1,350 | 65 |

| 3130 Via Siena Place | $1,980,000 | $1,900,000 | 28 | 3 | 2|1 | 1,762 | 7 |

| 638 Hubbard Avenue | $1,775,000 | $1,800,000 | 0 | 3 | 2|0 | 1,508 | 63 |

| 3397 Forbes Avenue | $1,655,000 | $1,700,888 | 7 | 3 | 2|0 | 1,462 | 61 |

| 2049 Larsen Court | $1,595,000 | $1,595,000 | 0 | 4 | 2|0 | 1,326 | 65 |

| 2162 Esperanca Avenue | $1,580,000 | $1,550,000 | 67 | 4 | 2|1 | 1,705 | 22 |

| 2979 Withrow Place | $1,598,000 | $1,540,000 | 23 | 3 | 2|0 | 1,659 | 66 |

| 1436 Jefferson Street | $1,599,888 | $1,537,000 | 81 | 3 | 2|0 | 1,784 | 45 |

| 981 Sunlite Drive | $1,349,000 | $1,500,000 | 4 | 3 | 2|0 | 1,347 | 73 |

| 2215 Gianera Street | $1,399,000 | $1,475,000 | 9 | 4 | 2|1 | 1,685 | 23 |

| 3655 Eastwood Circle | $1,500,000 | $1,468,000 | 39 | 4 | 2|0 | 1,778 | 54 |

| 2079 Brown Avenue | $1,298,000 | $1,455,000 | 7 | 3 | 2|0 | 1,095 | 64 |

| 338 Pineview Drive | $1,399,888 | $1,400,000 | 13 | 3 | 2|0 | 1,185 | 68 |

| 985 Civic Center Dr | $1,399,000 | $1,375,000 | 52 | 3 | 2|1 | 1,353 | 18 |

| 500 Woodstock Way | $1,298,000 | $1,340,000 | 11 | 3 | 2|0 | 1,312 | 55 |

| 2373 Homestead Road | $1,400,000 | $1,325,000 | 113 | 4 | 3|0 | 1,676 | 30 |

| 3360 Warburton Avenue | $1,299,888 | $1,275,000 | 56 | 2 | 1|0 | 1,009 | 68 |

| 986 Harrison Street | $1,288,000 | $1,270,000 | 7 | 2 | 2|0 | 1,438 | 92 |

| 2141 Bowers Avenue | $1,250,000 | $1,165,000 | 10 | 3 | 2|0 | 1,207 | 63 |

Santa Clara Housing Market Archive

January 2023 home sales CLICK HERE.

December 2022 home sales CLICK HERE.

November 2022 home sales CLICK HERE.

October 2022 home sales CLICK HERE.

September 2022 home sales CLICK HERE.

August 2022 home sales CLICK HERE.

July 2022 home sales CLICK HERE.

June 2022 home sales CLICK HERE.

April 2022 home sales CLICK HERE.

March 2022 home sales CLICK HERE.

February 2022 home sales CLICK HERE.

December 2021 home sales CLICK HERE.

November 2021 home sales CLICK HERE.

October 2021 home sales CLICK HERE.

September 2021 home sales CLICK HERE.

July 2021 home sales CLICK HERE.

May 2021 home sales CLICK HERE.

April 2021 home sales CLICK HERE.

March 2021 home sales CLICK HERE.

February 2021 home sales CLICK HERE.

January 2021 home sales CLICK HERE.

November 2020 home sales CLICK HERE.

October 2020 home sales CLICK HERE.

September 2020 home sales CLICK HERE.

August 2020 home sales CLICK HERE.

July 2020 home sales CLICK HERE.

June 2020 home sales CLICK HERE.

May 2020 home sales CLICK HERE.

April 2020 home sales CLICK HERE.

March 2020 home sales CLICK HERE.

January 2020 home sales CLICK HERE.