February Santa Clara Home Sales Recap

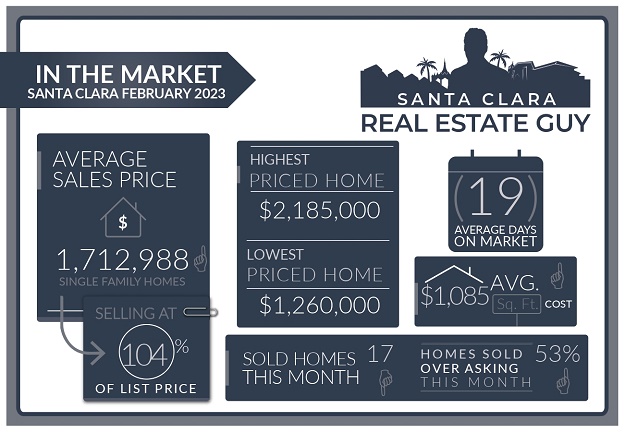

The Santa Clara housing market in February experienced 17 single-family homes that closed escrow, which is 2 less than closed escrow in the previous month of January. For some more perspective, last year there were 38 homes sold in February.

The average price of a home sold in February was $1.71M which is about $194K higher than the previous month’s figure of $1.52M. The median price home sold was $1.75M, about $270K higher than the median price in January.

The average cost per square foot saw an increase from $1064 per Sq. Ft. to $1085 per Sq. Ft.

Of all the 17 homes sold in February, 9 homes sold over the list price. On average homes that sold did so at 4.92% over asking compared to -0.05% under asking in the previous month.

We started the month of February with 31 active single-family home listings and finished with 27 active single-family homes for sale in all of Santa Clara. There were 27 single-family homes that accepted contracts in the month of February.

For a list of sold homes in February click here or scroll down to the bottom of the page.

Home Sales Down Year Over Year

The number of homes for sale in Santa Clara continues to be low.

When we refer to a slow market we are generally referring to how quickly homes are selling.

In our current market, some homes are selling quite fast. If priced accurately given the market conditions and the home, you can expect to sell within a week or two.

With such low inventory and limited good options, it’s definitely a seller’s market as motivated buyers have few options.

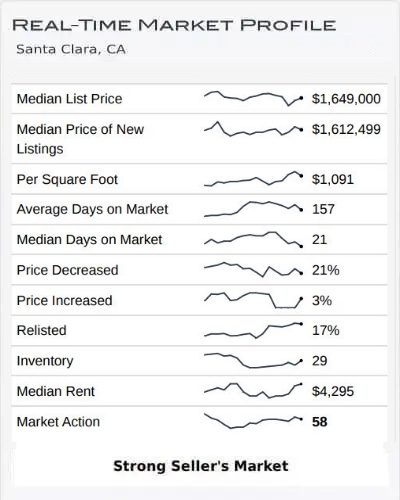

Altos Research Market Data For Santa Clara

Low Home Inventory

The beginning of the year is generally when we will see the lowest levels of homes for sale. Its rare that you would see less homes sell in February than in January but that is what happened in February.

Inventory did increase from January to February but decreased from February to March, another strange and not common scenario.

Although national and some local media outlets are reporting a slow real estate market and falling home prices, the reality in Santa Clara and some surrounding markets is that prices are holding up and demand is outweighing supply.

Santa Clara Market Reports

The Altos Research Market Action Index for single-family homes in Santa Clara has remained same as 58 from 58 where it was last month. For more detailed reports on Santa Clara and Santa Clara Zip codes, you can access the reports here.

Santa Clara Report

95051 Report

95050 Report

95054 Report

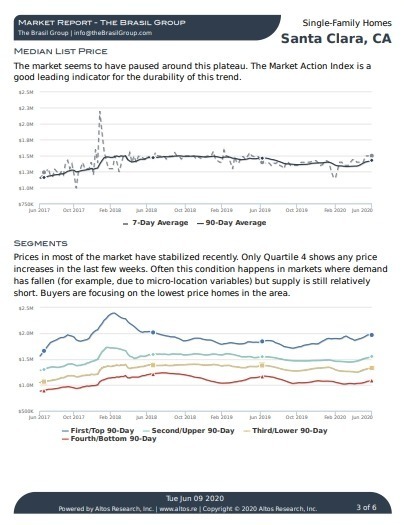

Home Values Holding Steady

As I mentioned above home values under the current low inventory conditions are holding up well, and appeared to have even ticked up last month. This month prices are also looking to make potentially some small gains.

Monitoring inventory levels will determine what direction the market is likely to go.

One easy way to do that is with the Altos Research Market Action Index (MAI) with is a proprietary metric that measures inventory and sales activity. The MAI in the last few weeks has been trending upward indicating that the market is getting stronger for sellers.

Generally as we move into the Spring the MAI is trending flat or starting to go downward.

Other Factors Influencing the Market:

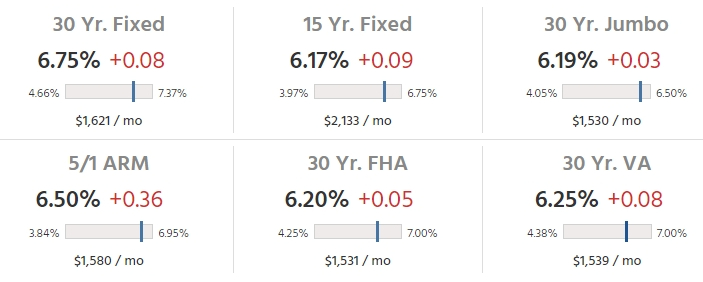

Mortgage rates have been everywhere in the last months. First they dipped then shot up back to 7 and now they are hovering around the mid-6% range.

There is so much uncertainty and complex factors influencing the market that that Wall Street is having a hard time trying to decide what the FEDs next move is.

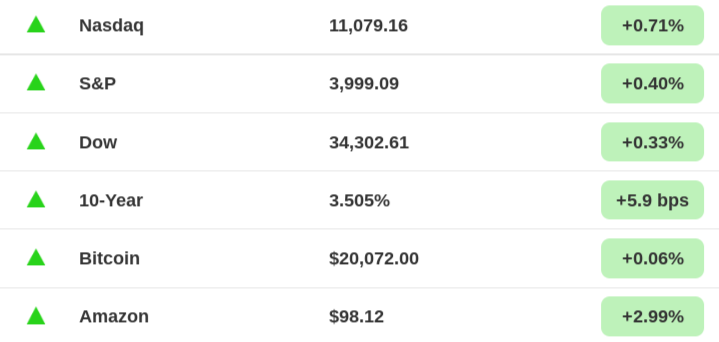

Markets Year to Date

Since the beginning of the year the stock market has been rallying.

There have been no major developments or changes to fuel the market. Just speculation from Wall Street.

We are entering earnings season and the word on the street is that many CEOs will be pessimistic about the economy moving forward. This may however, be positive for the stock market as bad news means the FED is likely to intervene sooner rather than later.

Home buyers in our local market rely on tech stocks for their down payment and for their loan qualifications. The impact on stock values affects home buyer affordability and purchasing power.

With interest rates dropping, stocks higher, and limited inventory things are looking better for home sellers.

Layoffs around the bay area continue to make headlines. Google just announced 12,000 layoffs across all departments and levels.

You can follow the number of layoffs and what firms have been affected on the San Francisco Chronicle Layoff Tracker webpage.

Save thousands when you sell.

Includes Free Staging and Our Complete Selling Solution

* Total commission 4% including buyer side agent commission of 2.5%, offer varies by value of home.

What to Expect Moving Forward

Buyers, have we hit the bottom?

If you have been looking for a few weeks you probably feel like the market has picked up and it has.

With the current state of rates, stocks, and low home inventory buyers are probably feeling a bit more confident these days.

The question is where do we go from here?

I admit I am really surprised that the stock market has been so positive in the last few weeks. This optimism has also caused mortgage rates to drop close to 6%, something I also didn’t think would happen so soon in the year.

The one thing that I am certain of is that home inventory will likely be low throughout the year.

Although I expect the current stock rally won’t be sustained and that mortgage rates to probably hang around the low to mid 6% range in the next few weeks and months, I don’t foresee a situation where inventory will climb to very high levels.

This will help home values remain strong at least for the short term.

All this optimism isn’t going to be good for inflation and may cause the FED to continue to raise rates.

The last time the FED reversed its rate hike plans in 2018 it may have been prompted by the stock market sell-off. This time the stock market is holding up, and there is inflation which wasn’t a factor in 2018, which makes me wonder if that will prolong the period before the FED reduces rates.

As you can see, there is no way to know how this will play out.

My advice to buyers is to continue to shop and be active. Home buyers are likely to start getting nervous once they hear about the multiple offer situations happening in the market. This can cause more aggressive bidding and competition, so be prepared.

I think in a matter of a few weeks, we will start to see the stock market sell-off

again as the market stalls and the reality of the FED not backing down sets in.

In the meantime, conditions for buying in the market should be improving in the coming weeks as more homes eventually come on the market.

Sellers, there is very little competition out there right now if you are selling a home.

This situation may continue for several weeks, even months. Typically inventory starts to really climb in the March to April months. By May and June the market isn’t moving so quickly because buyers have more homes to choose from and many have already bought homes.

That is what typically happens, I am not so sure that will be the case this year. Sellers seem to be choosing to sit this market out for whatever reasons.

My advice to sellers is if you want to make a move especially if you are thinking of making a move to a market where there is more new construction and supply of homes like Nevada, Idaho, and Texas then this market may be a great opportunity.

There are lots of reasons why selling and buying in this market makes sense. Here is an article I wrote on the advantages of selling in slow markets.

Instead of offering general suggestions here, I would encourage sellers who have questions and concerns about selling in this market to reach out to an agent.

Understanding your specific situation helps in determining how this market will affect you and your options. I offer free consultations to buyers and sellers to discuss their needs, so please reach out, I am always happy to help.

Conclusion:

As always, whether you are buying or selling, understanding the current market will set you up for success. As I mentioned above some homes are doing quite well in this market.

Understand that the housing stock of Santa Clara is very diverse and can vary greatly from one neighborhood to the next.

Developing the right strategy for you, whether you are buying a home or thinking of selling your current home is important to succeeding in this market.

If you have any questions about a home on the market or your home’s value, please feel free to reach out, I am happy to meet and help you understand your options.

Contact Me Today

Have a question? Interested in setting an appointment to talk about your real estate plans? Contact me today.

Message Me Directly:

Santa Clara February 2023 Home Sales

| Street Address | List Price | Price | DOM | Beds Total | Bths | Sq Ft Total | Age |

| 763 Valley Way | $2,198,000 | $2,185,000 | 11 | 4 | 3|1 | 2,584 | 63 |

| 3441 Tracy Drive | $2,200,000 | $2,125,000 | 6 | 3 | 2|0 | 1,420 | 66 |

| 2654 Brady Court | $1,899,000 | $2,105,000 | 6 | 3 | 2|0 | 1,737 | 67 |

| 765 Purdue Court | $1,890,000 | $1,981,000 | 7 | 4 | 3|0 | 1,954 | 62 |

| 3250 Warburton Avenue | $2,099,000 | $1,920,000 | 5 | 3 | 2|0 | 1,770 | 69 |

| 3197 Forbes Avenue | $1,648,888 | $1,910,000 | 12 | 3 | 2|0 | 1,442 | 61 |

| 727 Asbury Place | $1,900,000 | $1,842,000 | 65 | 4 | 3|0 | 2,473 | 65 |

| 677 Cambridge Drive | $1,699,000 | $1,750,800 | 8 | 3 | 2|0 | 1,462 | 62 |

| 4181 Marston Ln | $1,795,000 | $1,745,000 | 100 | 3 | 2|1 | 1,754 | 20 |

| 2880 Mark Avenue | $1,499,000 | $1,650,000 | 7 | 3 | 2|0 | 1,170 | 66 |

| 2286 Lenox Place | $1,428,000 | $1,546,000 | 6 | 3 | 2|1 | 1,667 | 25 |

| 1425 Newhall Street | $1,548,000 | $1,526,000 | 40 | 4 | 2|0 | 1,689 | 76 |

| 2329 Susan Drive | $1,499,950 | $1,450,000 | 21 | 3 | 1|1 | 1,232 | 67 |

| 1192 Block Drive | $1,150,000 | $1,410,000 | 6 | 3 | 1|1 | 1,156 | 72 |

| 2198 Bohannon Drive | $1,400,000 | $1,410,000 | 9 | 3 | 1|0 | 1,364 | 71 |

| 953 Scott Boulevard | $999,000 | $1,305,000 | 6 | 2 | 1|1 | 1,302 | 67 |

| 605 Malarin Avenue | $1,260,000 | $1,260,000 | 0 | 3 | 2|0 | 1,484 | 72 |

Santa Clara Housing Market Archive

January 2023 home sales CLICK HERE.

December 2022 home sales CLICK HERE.

November 2022 home sales CLICK HERE.

October 2022 home sales CLICK HERE.

September 2022 home sales CLICK HERE.

August 2022 home sales CLICK HERE.

July 2022 home sales CLICK HERE.

June 2022 home sales CLICK HERE.

April 2022 home sales CLICK HERE.

March 2022 home sales CLICK HERE.

February 2022 home sales CLICK HERE.

December 2021 home sales CLICK HERE.

November 2021 home sales CLICK HERE.

October 2021 home sales CLICK HERE.

September 2021 home sales CLICK HERE.

July 2021 home sales CLICK HERE.

May 2021 home sales CLICK HERE.

April 2021 home sales CLICK HERE.

March 2021 home sales CLICK HERE.

February 2021 home sales CLICK HERE.

January 2021 home sales CLICK HERE.

November 2020 home sales CLICK HERE.

October 2020 home sales CLICK HERE.

September 2020 home sales CLICK HERE.

August 2020 home sales CLICK HERE.

July 2020 home sales CLICK HERE.

June 2020 home sales CLICK HERE.

May 2020 home sales CLICK HERE.

April 2020 home sales CLICK HERE.

March 2020 home sales CLICK HERE.

January 2020 home sales CLICK HERE.